Sourcing Banking Talent in Japan: An Inside Story

Amidst a bleak global economic outlook caused by concerns for an upcoming US and European recession as well as spillover from the Russia-Ukraine war, the Asian banking sector remains resilient carving out a positive niche for itself amidst turbulent international conditions. The recent conflict involving Israel and Hamas has only intensified this situation, further unsettling an already fragile world economy.

Japan’s economy has been growing at a moderate rate, although at a rate that has put it behind other global market leaders. New projections have indicated that Germany would overtake the nation’s GDP this year, as a weak yen continues to inflict prolonged inflation. The Bank of Japan recent stepped away from rate controls as it looked to normalise monetary policy in hopes of inducing interest rate hikes, bringing back investor appeal into its own domestic debt. Additionally, the government has committed to a 17 trillion-yen stimulus package aimed at cushioning inflation and boosting consumption.

To learn more about the intricacies of Japan’s banking and finance sector, we spoke with Jack Brennan, Manager for Banking and Finance Services for Hays Japan to learn how this industry has evolved to fit the market and what challenges candidates and businesses are facing today.

Japan banking and finance has embraced the future of technology

While local economy contributes much to the success of this critical sector, there is also much to be said about the flexibility Japan banks have taken in their approach towards updating their processes to be future-ready. Japan consumers today now enjoy a variety of digital-ready products and services that make the banking process much easier.

On paper, these innovations are being seen as a step towards bridging the gap between two important segments of the population. First of these are rural communities with limited access to physical banks benefit greatly from the availability of online services, allowing them to perform transactions without the hassle of traveling long distances to visit an outlet.

But technology benefits more than just marginalised groups. These innovations are crucial for appealing to a new generation of users that are embracing the digital world more keenly than ever before. From simple utilities such as being able to transact via mobile devices to integrated payment functions linking vendors to customers with simple QR codes, Japan banks are doing what they can to market themselves to Gen-Z as institutions that cater to their unique needs.

Japan banks are adopting artificial intelligence faster than ever

As the world of work continues to evolve at a breakneck pace, flexibility has become a key component for organisations sourcing for the right talent to support their operational needs. Nowhere does this feel more pronounced than in the tightly regulated banking and finance industry, where necessary change is fought for at every step of the way.

Leading this change is AI and automation technology, which Japan banks have been quick to adopt to. Mizuho Bank recently implemented Microsoft’s Azure OpenAI, giving its 45,000 employees access to generative AI technology. The technology is expected to be used for streamlining language in emails, documents pertaining to loan proposals and contracts and making administrative inquiries.

But at the very center of it all, banks understand the need to maintain a human touch in their strategy. Today, front office positions are in high demand, with many banks looking to secure existing staff by offering large salary increments and associated benefits. This is supported by robust hiring strategies to fill vacancies, as financial institutions look towards building a better candidate experience to entice applicants.

Where AI adoption has not yet seen heavy use is in the talent recruitment space. The candidate acquisition process is still very much a traditional one, with a preference towards internal acquisition teams, agencies or referral programs.

Virtual Banking is growing in Japan

Worldwide, digital banks have been growing in popularity among users for providing a seamless, trouble-free digital on-boarding process. This is especially true in Asia where a fifth of the world’s virtual banks current preside, offering contemporary, cloud-driven architecture, exceptional user engagement, and a readiness to integrate their financial services into existing platforms to the tune of user engagement.

The Sumitomo Mitsui Financial Group recently made waves with the launch of its digital banking service in the US. The newly minted Jenius Bank seeks to capture North American consumers with competitive personal loans and aims to make a net profit within 10 years. Locally, Japanese digital bank Habitto is allowing customers to open savings accounts with a lucrative 0.3% interest on the first one million yen deposited.

What banking and finance roles are in demand in Japan?

After the hiring rush of 2022, demand for foreign banking roles and asset managers have slowed down significantly in 2023, with many of them prioritising cost-saving and budget efficiency. However, onshoring has also been growing in popularity, with many banks looking to bring back previously offshored functions, reopening these positions to local candidates.

Overall, the Japanese job market is still candidate short, with demand greatly exceeding supply. This is a good opportunity for prospective talents looking to break into an industry known for high renumeration and solid career growth.

Junior positions in demand include middle office operations in equity, various compliance related functions, credit risk analysts, sales and M&A analysts. Bilingual candidates will find themselves at an advantage for roles, with Python knowledge, CFA qualifications and stakeholder management skills being necessary depending on the position.

Management positions current in demand include roles in compliance, risk management, investment, finance and sales strategy and planning. Managers will want to pick up ACAMS, CFA, FRM, CPA qualifications, and possess team management skills to excel in their roles.

In an evolving market like banking and finance, we understand the importance of having quick access to top talent who will make a real difference. We have spent years nurturing an ecosystem of highly engaged and unique candidates and will work with you to grow or scale your business using our unique expertise aligned to sectors and technologies. Be sure to reach out to us if you have a position that needs filling.

What are Japan employers doing to find talent in banking and finance?

With candidates in short supply, Local Japanese banks have turned to poaching top talents from foreign banks as well as asset managers which have seen reduced demand.

Remuneration packages tend not to greatly exceed a candidate's previous salary, and instead are balanced out with attractive work flexibility, allowing candidates to pursue better work-life balance.

Banks are also offering talents well versed in English the opportunity to work with offshore stakeholders and counterparts, providing valuable connections instrumental to a candidate’s career growth. Internal mobility is supported for candidates looking for a change in environment and workspace.

Should they risk losing valued personnel, banks are also open to counteroffers, with the goal of persuading them to stay. These rarely include an immediate increase in compensation, instead offering a change in coverage or increased responsibility to aspiring talent.

As recruitment experts in banking and finance, we can help candidates navigate their prospects, equipping them with the tools to make the best employment decisions. Reach out to us and begin strategising the next phase of your career in banking and finance.

Where does Gen-Z fit into the Japan banking and finance talent strategy?

The world of banking has grown increasingly intertwined with technology, and Japan banks understand this in principle. With a customer-centric focus when adapting to modern technology, financial institutions will now have to direct that same focus towards the search for talent. Understanding the demographics of this talent then, is key to developing a holistic strategy to ensure the talent pool doesn’t dry up.

At the very centre of this focus is Gen Z; a digitally savvy generation with formative experiences from the pandemic. This talent class feels at odds with the traditional working structures of a banking culture that has long been exemplified as an office job with long hours ahead of employees looking to climb the corporate ladder. Despite this contrast of values, organisations have much to gain from attracting and retaining Gen Z into the world of banking.

・Prioritise employee wellbeing

The trend of "quiet quitting" and more recently, “lazy girl jobs” gained momentum these past two years, with employees minimising their efforts to cope with extended workdays and rising health concerns. These terms have struck a chord with Gen Z, who are increasingly prioritising their well-being over their careers.

Today, many banking and finance companies have made investments in physical and mental health programmes for employees. Initiatives such as extended bereavement leave, gym memberships and flexible work arrangements are gaining popularity as organisations look towards providing the resources employees need to stay healthy in all aspects.

・Encourage diversity, equity and inclusion (DE&I)

This generation is passionate about creating a more equitable and inclusive world. To meet their expectations, many companies in the banking and finance sector have taken significant steps to promote diversity and inclusion. This ranges from diverse hiring practice actively seeking a variety of backgrounds, experiences, and talents to implementing inclusive policies supporting gender and ethnic inclusivity.

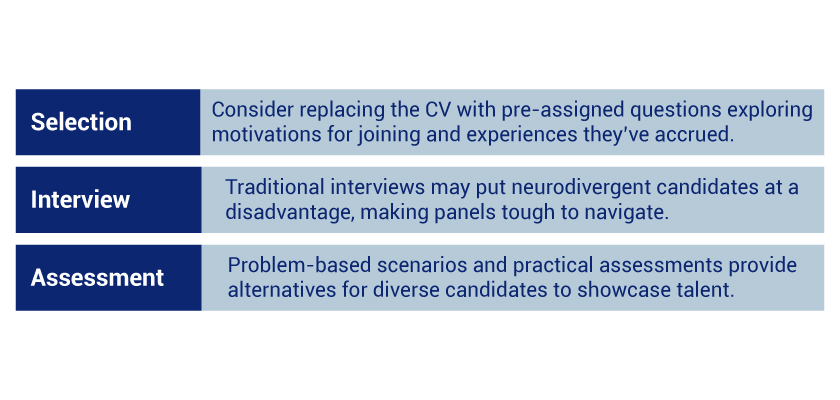

The world of work has long realised the benefits of a diverse workforce. Consider review the following tips to see if your hiring practices are detrimental to skilled professionals:

・Invest in training

Given the persistent shortages of critical skill sets in the banking and finance sector, it is prudent to explore alternative avenues for finding individuals who meet these demands. Nurturing the necessary skills in both new and current employees through training, upskilling, and career development initiatives, especially in light of ongoing technological advancements, is a strategic move.

Shifting the focus from job-seeking to skill-mining will also expand the pool of available talent. This is particularly relevant for positions requiring back-office professionals with programming expertise, a skill that might be more prevalent in certain technology-related industries.

As a lifelong partner to businesses in Japan, Hays is well placed to find the right solutions to your staffing needs. From identifying existing talent to training those with potential, we’re working for your tomorrow to help your organisation succeed in the short and long term.

To register a vacancy please click below and enter the details in the form.

Latest articles

Salary Guide

A comprehensive report providing you salary and recruitment trends to guide your talent strategy for the year

Register now

Start your job search by registering your CV and signing up to job alerts.

Salary checker

Find out how your salary compares with your peers in Japan to benchmark your current and future earnings.